Efficient Approaches for Funding Collection: Recoup Your Debts

Are you having a hard time to recuperate your arrearages? Look no further! In this article, we will provide you with effective strategies for loan collection. You will discover just how to comprehend financial obligation recuperation techniques, construct much better interaction with borrowers, carry out an organized collection process, make use of modern technology for reliable debt administration, as well as navigate lawful considerations. With these actionable ideas, you can take control of your loan collection procedure as well as efficiently recoup your financial obligations.

Recognizing Debt Healing Techniques

To successfully recover your financial obligations, you need to comprehend debt recovery methods. One crucial strategy is communication.

An additional reliable financial debt recovery method is paperwork. Furthermore, it assists you remain organized and also track the progression of your financial debt collection initiatives.

Furthermore, making use of the solutions of a financial debt collection agency can considerably improve your opportunities of effective financial debt recovery. These agencies have the expertise and also resources to manage the collection process in your place. They employ numerous methods, such as miss mapping and credit report coverage, to situate borrowers as well as encourage punctual payment.

Structure Effective Interaction With Debtors

Beginning by reaching out to your consumers in a friendly and specialist way. Let them recognize that you are mindful of their arrearage and that you are willing to function with them to find a solution. Show compassion and understanding towards their situation, however likewise make it clear that you expect the financial obligation to be settled.

During your discussions, be certain to actively pay attention to what your borrowers need to say. Ask open-ended inquiries to encourage them to share their obstacles and also problems - credifin. This will help you acquire a better understanding of their financial situation and allow you to come up with an ideal repayment strategy

Keep normal call with your consumers throughout the financial debt recovery procedure. This will aid them really feel supported as well as will additionally function as a suggestion of their commitment to pay off the financial debt. By remaining in touch, you can resolve any kind of problems or worries that might emerge as well as maintain the lines of interaction open.

Implementing a Structured Collection Refine

By implementing an organized collection procedure, you can enhance the financial debt recuperation procedure as well as boost your opportunities of obtaining back what is owed to you. Having an organized technique suggests having a clear strategy in position to take care of financial debt collection. This includes establishing up certain steps as well as procedures to follow when taking care of borrowers who have impressive debts.

It is crucial to develop a timeline for debt collection. This timeline ought to describe the specific activities that need to be taken at different stages of the process, such as sending out tips, issuing cautions, and even taking lawful activity if essential. By having a clear timeline, you can make sure that you are continually and proactively pursuing the recuperation of the financial debt.

Carrying out an organized collection procedure indicates having a systematic approach to documents as well as record-keeping. This includes keeping precise documents of all interactions with borrowers, as well as any agreements or pledges made pertaining to repayment. Having these documents easily available can try this help you track the progress of each situation as well as offer proof if lawful activity ends up being required.

A structured collection procedure entails regular surveillance and also assessment. This indicates on a regular basis evaluating and examining the performance of your collection initiatives. By identifying any areas of enhancement or patterns in customer behavior, you can make necessary modifications to your techniques and enhance your possibilities of effective financial obligation recovery.

Utilizing Technology for Effective Debt Management

Making use of technology can substantially enhance the performance of handling your debt. With the innovations in innovation, there are now a myriad of devices and sources readily available to assist you improve your financial obligation monitoring process. One of the most effective ways to use innovation is by utilizing financial obligation monitoring software application.

Legal Considerations in Loan Collection

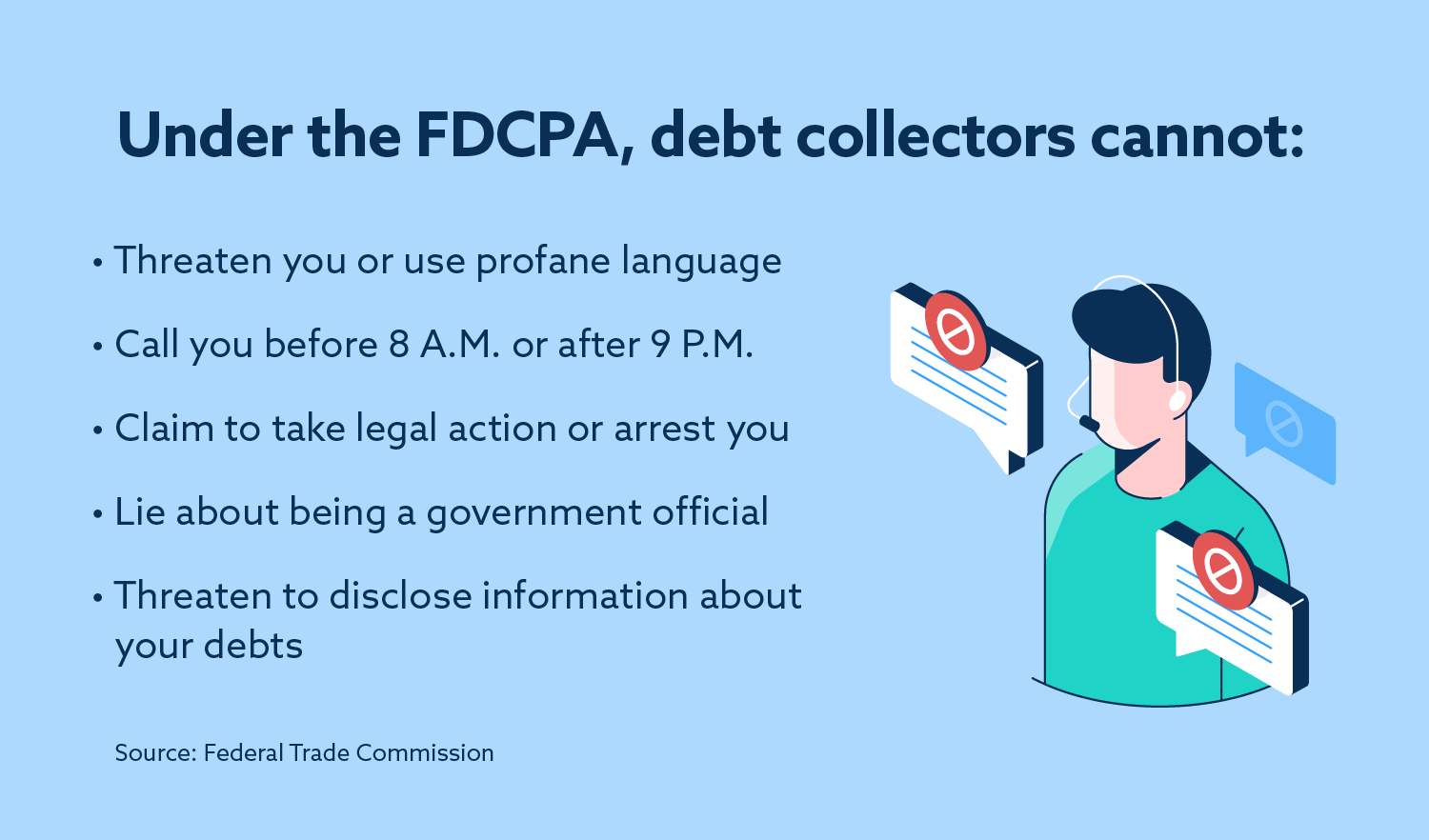

Legal factors to consider play a vital role in the collection of lendings. It is important to comprehend the lawful aspects included when it comes to recouping your financial obligations. One of the very first points you need to consider is the law of restrictions. Each state has its very own time frame for accumulating debts, and once that time has actually passed, you might no more deserve to go after lawsuit. It's also essential to familiarize yourself with the Fair Financial Obligation Collection Practices Act (FDCPA), which establishes guidelines on how financial debt enthusiasts can connect with consumers. This includes constraints on when as well as just how typically you can contact the consumer, in addition to rules against harassment or misleading techniques. Additionally, you need to be familiar with the details laws as well as regulations that control your market. If you are a home loan loan provider, you need to be acquainted with the Real Estate Negotiation Procedures Act (RESPA). By recognizing and also following the legal considerations in funding collection, you can make certain that you are running within the boundaries of the legislation while maximizing your possibilities of recouping the financial debts owed to you.

Verdict

Finally, by carrying out reliable strategies for loan collection, you can successfully recuperate your financial debts. browse around this web-site Building strong communication with borrowers and also carrying out a structured collection procedure are vital. Making use of modern technology can additionally significantly boost debt management performance. Nonetheless, it is necessary to be familiar with lawful factors to consider when accumulating fundings (credifin). By complying with these methods, you can raise your possibilities of successfully recovering the financial debts owed to you.

You will find out exactly how to recognize financial obligation healing methods, construct far better interaction with consumers, have a peek at these guys carry out a structured collection process, make use of innovation for reliable financial obligation monitoring, and also browse legal factors to consider. To efficiently recover your debts, you need to understand financial obligation recovery techniques. Using the services of a financial debt collection agency can greatly improve your possibilities of successful financial debt healing. It's likewise crucial to familiarize yourself with the Fair Financial Obligation Collection Practices Act (FDCPA), which establishes standards on just how financial obligation collection agencies can connect with customers. By understanding and adhering to the legal considerations in car loan collection, you can make sure that you are operating within the limits of the regulation while optimizing your opportunities of recuperating the financial obligations owed to you.